According to Bloomberg, Black people pay more in taxes than white people with the same income! Why? Because tax policies were created to benefit white people. Have you ever heard of the “Seaborn tax?”

In 1930 Henry Seaborn, a rich white man, sued the U.S. Government because he thought his taxes were too high. He eventually WON – and got to split his income with his stay-at-home wife, decreasing their tax bill.

This had a much bigger impact on Black families than you might think.

Tax codes claim to not be influenced by race – but when Congress lowered Seaborn’s tax bill, it meant households with one high-income earner will pay less in taxes than households with two working people. Like most Black households!

This actively contributed to Black people not being able to save enough to establish generational wealth for their families. We already earned less, so both people had to work – and then on top of that we were taxed more! The racial impact of this tax change persists today.

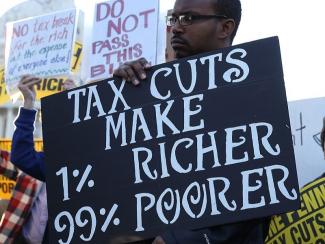

We have to be honest about every aspect of the wealth gap – it’s not just income disparities. The entire financial system of the U.S. was built to benefit white, wealthy people, not us. Black liberation is only possible if we learn the truth about how the system operates!